In the face of economic turbulence, which continues to rattle the economy and nonprofits, many are asking: what can I do? The CARES Act, a sweeping $2 trillion stimulus bill passed by Congress in response to COVID-19, encourages individuals across the income continuum to participate in the American tradition of charitable giving. Your consideration of giving at this time is admirable. Your actions can be driven by three questions:

Who should I support with a charitable gift now?

Every nonprofit is struggling. We suggest you start with the organizations that you’ve traditionally supported. Is your museum membership about to expire? Renew it—and consider an upgrade. Did you purchase tickets to a performance or special event? Convert them into an outright gift. Is your alma mater holding its annual campaign? Consider a gift to help today’s students in this uncertain time.

Next, consider organizations helping society navigate this difficult time: those that provide food, shelter, healthcare. Across the country, local community foundations and/or United Ways have emergency response funds. Or, look to the organizations seeking solutions: either to the health crisis (CDC Foundation, World Health Organization, research universities and hospitals), or to redress the economic toll (Restaurant Workers’ Fund, Legal Aid). Check out these suggestions from Forbes or the New York Times.

How (and how much) should I consider giving?

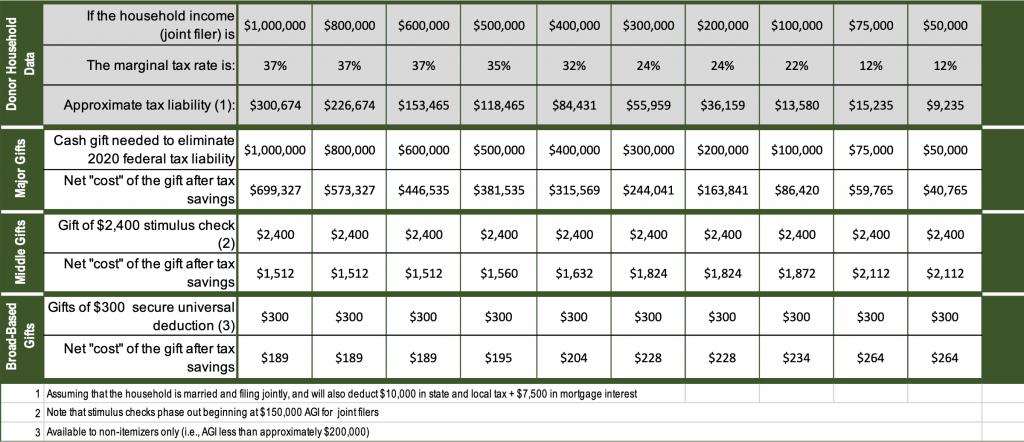

Of interest to higher-net-worth households: the CARES Act will lift the adjusted gross income cap for 2020 for gifts of cash (or perhaps by combining appreciated assets for the traditional deduction amount and cash for the remainder—the act is unclear so consult your tax advisor). You’ll do well by doing good: supporting a meaningful cause, while eliminating capital gains taxes and reducing your taxable income.

At the same time, gifts of all sizes are essential to fuel resilient nonprofits—now more than ever. The CARES Act will establish a $300 universal charitable deduction in 2020. Give $3; give $30; give $300. If you will receive a stimulus check from the CARES Act, but have the good fortune of stable work or robust savings, consider giving back in this way as well.

For Major Donors

Elimination of adjusted gross income caps for individuals’ charitable deductions

Households can deduct cash gifts of up to 100% of their adjusted gross income, effectively eliminating their federal tax liability in 2020. (In an effort to encourage immediate giving, donations to donor-advised funds will not qualify.)

Households that rely primarily on assets (vs. annual income from compensation) will find this very attractive.

The increase in gift deductions may be used to make new gifts, or to prepay an existing multi-year pledge.

For Many Donors

Not everyone needs “Recovery Rebates”

Eligible households will receive payments of up to $2,400 (joint filers) plus $500 per child.

For many, these payments are an essential lifeline. Other households may not need the cash—especially those with stable work or retirees who will continue to draw on assets.

And, as an added incentive, the payments are received tax-free, but charitable gifts can result in a tax deduction.

For the Broad Base

$300 Universal Charitable Deduction

Non-itemizers (about 90% of all households) can claim a deduction for up to $300 in charitable giving (possibly $600 for a household filing jointly).

Watch for your causes to participate in giving days such as #GivingTuesdayNow (May 5) where your gift might be matched by gifts from others.

Why should I consider giving?

Giving is about much more than making a donation. It is about making a difference.

Your gift during this time of uncertainty will help to sustain essential services that are needed today. And your generosity will preserve the institutions that provide education and beauty, wonder and social progress—so they can lift our spirits and our society once again when the pandemic ends.

A charitable gift at this time is also a declaration of your faith in the future. It is an action you can take today that will not only make a difference to society; it will make a difference to your own outlook for the future. Scientific evidence confirms that charitable giving makes you feel better.

While tax benefits are rarely the primary consideration when making a charitable gift, the advantages of the CARES Act may inform how—and how much—you can give at this time.

An illustration of the approximate potential tax benefits of giving in 2020:

Benefactor Group does not provide tax, legal, or accounting advice. This material has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, tax, legal, or accounting advice. Donors should consult their own tax, legal, and accounting advisors before engaging in any transaction.

For more information, please visit our Resources for Uncertain Times page.